The great paradox of the real estate business is that, on one hand, it’s the single largest asset class on the planet with a global estimate of $228 trillion, and it generates tremendous amounts of operating, financial and market-level data. On the other hand, real estate is an industry where too much of the decision-making process is done by gut, too much of the reporting process is done by spreadsheet and too few of the recurring processes leverage automation. The result is an industry that too often defaults to throwing humans at problems that systems have mastered.

But, the real estate game — and retail real estate, in particular — is changing. Data-driven systems are shifting the industry from the “Excel Hell” of spreadsheets to automated decision support tools based on your data, and automated tracking and reporting systems based on your business rules for recurring activities, including:

- Rent collections

- Retail sales tracking

- Leasing, lease renewal and deal flow analysis

- Proof of insurance compliance

- Consumer sentiment tracking

- Consumer location intelligence

- Portfolio acquisition and disposition analysis

When Information Scarcity Becomes Surplus

Futurist George Gilder once noted that when a formerly scarce resource suddenly becomes a surplus commodity, tremendous wealth is created through the innovation and industry transformation it fosters.

A good example of this is the role that the convergence of big data, cloud computing and mobile broadband played in the rise of Apple, Google, Amazon, Facebook, Netflix and Uber. In each instance, these companies were not only able to create high-margin, global-reach businesses that generate tens to hundreds of billions of dollars in revenue, but they changed our very concept of what media, communications, search/discovery, retail and transportation could be.

In the retail real estate space, these same dynamics are driving massive innovation in formerly sleepy market segments, such as property management, construction management, portfolio management, facility management and real estate agent tools. Innovation drove capital investment from venture capital and private equity to the tune of $20 billion in 2018 alone across commercial real estate segments ranging from property management and analytics to internet of things (IoT), construction management and real estate agent tools, according to Venture Scanner, which provides startup market reports and data across multiple business sectors.

![]()

A common industry driver is the fact that forward-thinking shopping center owners and operators want to extend the reach of their existing property management and accounting data to all of the folks outside of accounting. These personnel need access to the data inside of MRI or Yardi, but are unlikely to log into those environments themselves. This group typically includes executives, asset managers, property managers, leasing, lease administration, legal, analysts, marketing, development, due diligence, and third-party clients and investors.

The “win” associated with embracing a data-driven system is three-fold. First, it levels the playing field inside a company so everyone has access to the same information, meaning the company can deliver better service, make fewer errors and operate at scale with one voice. In this regard, such systems become the corporate memory ensuring best practices don’t walk out the door when key employees leave. These systems also provide a path to onboard new hires systematically.

Secondly, information, such as rent, merchant sales, occupancy, budgets vs. actuals, NOI, property type, tenant type, region and key lease provisions, can be standardized and then “warehoused” in databases where it accrues over time. Data-driven systems become push-button simple to spotlight key trends, track variances from prior periods and better benchmark performance relative to peers — both inside the company and cross-market.

Lastly, these systems are designed to ingest multiple data sources. This doesn’t simply include property management and financial data, but extends to consumer sentiment (think Yelp), location intelligence (think Google Maps or shopping center wi-fi data), marketing event data and merchant credit rating data, meaning that for the first time it is now possible to run analysis using “consolidated” data.

This approach enables portfolio owners and operators to better understand:

- Which retailers and retail categories are the healthiest or at greatest risk based on multiple factors, including timeliness of rent payment, occupancy cost percentages being within historical ranges, credit ratings, and consumer satisfaction based on quality, service and perceived value (which can be measured to track net promoter scores).

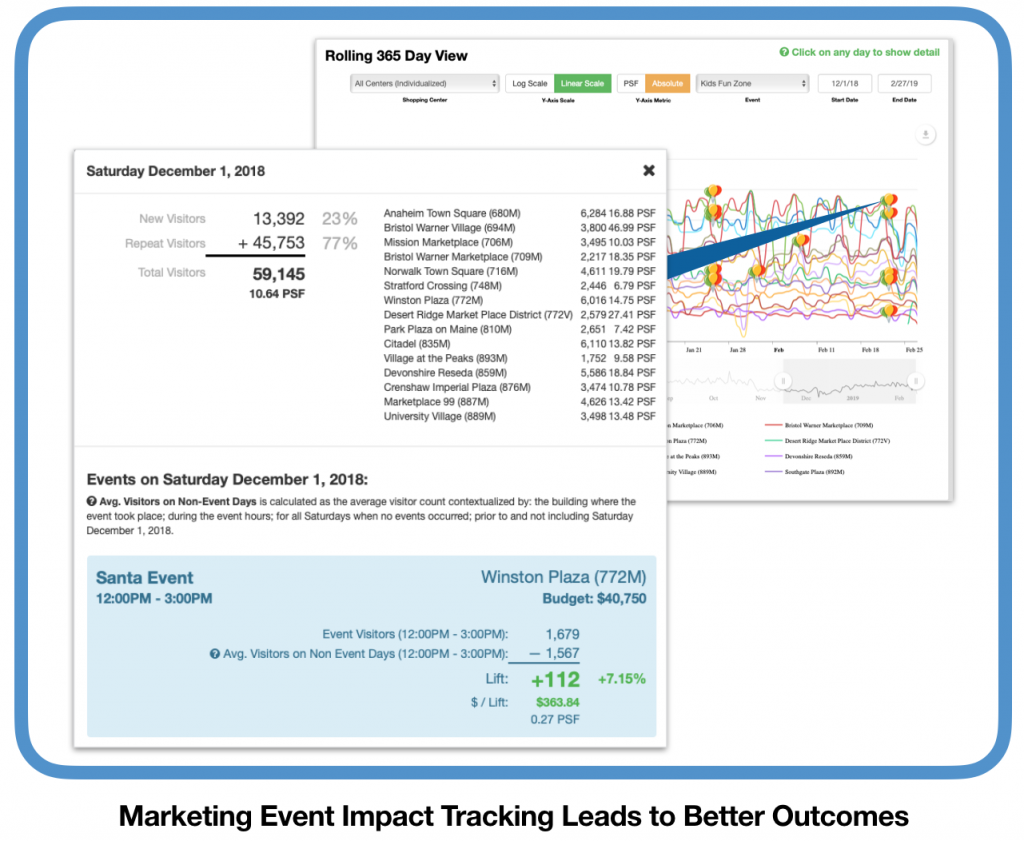

- Which center marketing events generate the high customer “lift” relative to non-event days at the lowest “cost per lift,” which events tend to lead to the most loyal customers and, as identified by massive mobile data patterns, which trade areas a given shopping center draws from.

- Which properties are the greatest acquisition or disposition targets. This can be analyzed based upon relative NOI performance to the center’s peers in a given region, or by merchant health scores (for key tenants and as a composite property), co-tenancy default exposure, and the impact of consumer shopping patterns and trade area reach.

The above examples are based on actual applications utilized by clients and partners that work with BrightStreet Ventures portfolio companies, representing tens of billions of dollars of asset value across thousands of retail properties and tens of thousands of retailers.

Netting it out, intelligent, actionable data — when coupled with automation — changes the game, and the future is here today.

— By Mark Sigal, managing director of BrightStreet Ventures, the real estate technology affiliate of NewMark Merrill Companies, a shopping center developer and manager with 10 million square feet of retail, and 1,500 tenants across 80 shopping centers in three states. BrightStreet Ventures invests in, incubates and advises numerous PropTech startups, including Datex Property Solutions (Real Estate Business Intelligence), Placer.ai (Location Intelligence) and MerchantCentric (Consumer Sentiment Tracking).

This post was published as part of Shopping Center Business’ Retail Insight series.